Home loan rates for the most popular banks in the Philippines for the year 2021

Home loan rates for the most popular banks in the Philippines for the year 2021

Where to borrow money to pay a seller to buy a house? Mostly banks. Rare instances are the finance cooperatives, savings and loan associations, relatives, and other private lenders. Buying a house, vacant lot, house and lot, townhouse, or condominium unit? There are so many options out there to choose from.

How do you obtain at least an estimate of monthly amortization? Visit my page on mortgage calculator here.

You have to be fully aware that you need to shell out the maximum of one-third of your combined monthly earnings (salary, business, commissions, inheritance, gains on stocks, etc.) so that you will not be surprise on how things will be.

What are the requirements on obtaining a bank loan? Coming from BPI, which could also be similar to what other banks would require, are the following:

A. Housing Loan Application Form

- Duly accomplished Application Form

- 2 valid government issued ID with photo and signature

- If married, both spouses to sign on the application form

- If with co-borrower or co-mortgagor, separate application form is needed

B. Income Documents

If locally employed (working within the Philippines)

- Certificate of Employment (COE) indicating salary, position and length of service

- Latest Income Tax Return (ITR) for the last 2 years

If Expat Pinoy (Overseas Filipino Worker)

- Contract / Certificate of Employment (COE) authenticated by Philippine Consulate

- Crew Contract and Exit Pass validated by POEA (seaman)

- Proof of monthly remittances

- Notarized or authenticated Special Power of Attorney (BPI FSB Format)

If Self-Employed

- Articles of Incorporation and By-Laws with SEC Registration Certificate

- Audited Financial Statements for the last 2 years

- DTI Registration

- Income Tax Return w/ Statement of Assets and Liabilities (SAL) for the last 2 yrs

- List of Trade References (at least 3 names with telephone nos. of major suppliers/customers)

- Bank Statements for the past 6 months

If Practicing Doctor

- Clinic address/es and schedule

If from Commission

- Vouchers or Bank Statements (last 6 months reflecting commission income)

If from Rental of Properties

- Rental/Lease Contract (indicating name of tenants and rental amounts with complete addresses of properties being rented)

- Photocopy of Title (TCT/CCT)

C. Collateral Documents

- Clear copy of Owner’s Duplicate Copy of TCT/CCT

- Lot Plan with Location/Vicinity Map certified by licensed Geodetic Engineer

- Photocopy of Tax declaration / Tax receipts / Tax clearance

- Endorsement Letter / computation sheet / Contract to Sell from developer stating the contract price (for accredited developer/project)

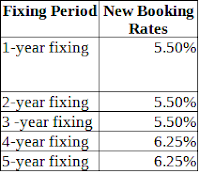

Do you understand how bank loan works? The fixing period means that the number of years that the specified interest rate can only be effective. Once it passes the fixing period, the interest rate will change again.

For example, for 3 years fixing period, the interest rate of a certain bank is 5.5%. The loan term or tenor is 15 years. Therefore, the interest rate will change every 3 years.

I do not recommend 1 year fixing period as it is volatile and will go with the dictations of the financial markets. I recommend 3 years or 5 years fixing period because no matter how fragile the economy is and interest rates are rising, the interest rate for your own loan agreement stays for the duration of the fixing period. For 1 year fixing period in a loan term of 15 years, the interest rate will change every year.

If you are irked that the monthly amortization you pay to the bank changes annually, you can opt to ask your bank, or another bank for refinancing. The bank will take out the loan out of its agreement and offer you a more secure interest rate.

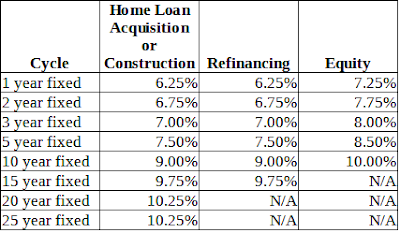

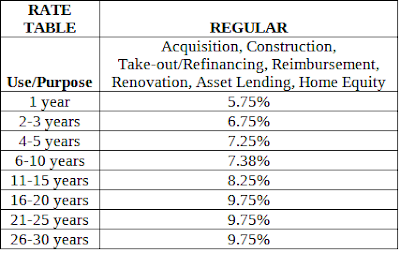

For the rates posted below, the indicative rates are not final, as you can negotiate it with your loan officer. Please ask your local bank manager about home loans and what rates you could get.

I recommend the following banks for you to have your own loan:

Bank of the Philippine Islands (BPI)

Comments

Post a Comment