Definitive Guide for Establishing Taxable Price of Real Property Sold or Donated in the Philippines

Primer

The role of taxation in every country is to provide funds for building infrastructure, sustaining personal benefits, enforcing police power, and more. In Philippines, we have income tax, real property tax, documentary stamps tax, capital gains tax, and many more. In real properties such as house and lot, lot, condominium, townhouse and more, we pay the following taxes: 1) capital gains tax, 2) documentary stamps tax, 3) donor's tax, 4) estate tax, and more.

This guide refers only to establishing the taxable price for real properties that has undergone sale or donation.

This article is limited only to the interpretation and experience of the author. Any other interpretation or addition to the article is welcome and comments can be posted. The author will reply as soon as possible

How to compute for the taxable price of property sold?

There are three bases for establishing the taxable price of real property that has undergone sale. The three bases are zonal value, market value from tax declaration, and selling price. A Deed of Absolute Sale (

template document available here) must be executed unilaterally or bilaterally. For properties sold by

natural person to another natural person, the following must be established:

Zonal value

As this author would like to define it, zonal value is a government-defined price of real properties in a certain location based on its property type (residential, commercial, industrial, agricultural, etc.) at a certain period of time. The zonal value of properties in a certain BIR district is updated whenever it calls for an occasion by conducting series of public and private consultations. Some BIR districts updates every 3 years, some BIR districts do not. In Metro Manila, zonal values of most cities are updated within the last 5 years.

How to get the zonal value of a certain property in BIR?

To get the zonal value of a certain property in BIR, the following things must be ready on-hand:

- Tax declaration - where the location of the property is.

- Original / Transfer / Condominium Certificate of Title. OCT, TCT, or CCT determines also where is the location of the property.

- Actual and verifiable knowledge of the location of the property.

For land properties - lot, block, street, and barangay details must be available. For condominium properties, the name of the condominium and its nearest condominium must be known and fully established. For properties that have its street or barangay name changed in the past, a tax map must be available. It can be requested by the local municipal or assessor's office

Once the address or location of the property is identified, we can locate the property by reading the BIR zonal values.

Step-by-step procedure on identifying zonal value

- Visit the website of BIR zonal values.

- Locate the province, city, or municipality of the property. If you are using computer, you can use Ctrl + F and type the keyword.

- Download the zip file and unzip the file using your archive utility. For Microsoft Windows, you can use WinRaR or 7-zip.

- Open the Excel file using your own spreadsheet software. You can use Microsoft Office, LibreOffice, Google Sheets, or other spreadsheet software you actually use.

- Establish the date and year of the transaction. When was the property sold?

- Locate the worksheet that you need in the file. If the property is sold in the current year, open the latest worksheet. If the property is sold many years back, select the worksheet that relates to the year the property is sold.

- Locate the municipality, barangay, village (if any), street (if any), nearest condominium (if zonal value for the condo is not yet established).

- Identify the type of the property - is it residential regular, residential condominium, commercial regular, commercial condominium, agricultural, etc.

- Once identified, you can see to the right of the location the zonal value.

Example 1: A residential condo unit with floor area of 27.37 square meters located in Light Residences, Barangay Barangka Ilaya, Mandaluyong is sold. What is the zonal value?

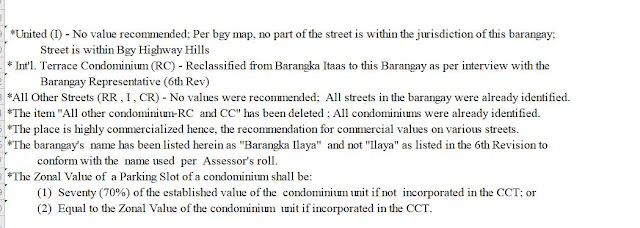

The zonal value file is here. Mandaluyong is located in BIR RDO 41. Light Residences is a condo complex located in Barangay Barangka Ilaya. Before, the referred old condo nearest to Light Residences prior to its establishment is Pioneer Highlands.

On 2019, the residential condo unit (RC) has an established zonal value of PHP 111,000.00. The zonal price is multiplied to the floor area in square meters. The zonal price is 3,038,070.00

Example 2: A stand-alone parking lot unit with floor area of 12.50 square meters in Light Residences was sold last March 2021. What is the zonal value? It must be established that the worksheet contains notes with regards to parking lot units in a certain condominium. Therefore, we must follow the interpretation of the notes:

We must qualify where the parking lot would go. Does the parking lot have its own CCT separate from a condo unit? If yes, the value is 70% of the established value of residential condo. If not, the parking lot value has 100% of the established value.

Since the problem stated that the parking lot is stand-alone and has a separate CCT, the value is 70% of the established value of the residential condo. The zonal price is 12.50 x 111,000.00 x 0.7 = 971,250.00

Market Value from Tax Declaration

To establish the market value from tax declaration is easy. The steps are as follows:

- Get the tax declarations that refers to land and building/improvement of a property. To be sure, get the latest certified true copy of a tax declaration. For house and lot, townhouse, and lot, this would be enough. For condo units and parking slots in a condominium, a tax declaration referring to building/improvement would do.

- Locate the value that refers to market value. Assessed value is different and will not be part of taxable value.

Example 1: A vacant residential lot in Antipolo was sold and the latest certified true copy of the tax declaration of the lot was provided. Altogether, the seller also provided the Certificate of No Improvement to certify that no building/improvement was introduced to the property. Upon inspection of the tax declaration, market value is set at 100,000.00. Therefore, the market value of the land is 100,000.00.

Example 2: A house and lot in Makati was sold and the latest certified true copies of the land and building/improvement was provided. Upon inspection of the tax declaration, the market value for the land is set at 200,000.00, and the market value for the building/improvement is 1,200,000.00. Therefore, the market value of the land and improvement is 200,000.00 and 1,200,000.00 respectively.

Example 3: A house and lot was sold and only the latest certified true copy of the tax declaration of the lot was given. No tax declaration was obtained from the municipal hall for the building/improvement. Therefore, only the market value of the land can be established. The market value for the building must be established by submitting new information and documents to the assessor for assessment, prior to paying taxes in BIR.

Selling Price

Establishing the selling price is fairly easy. It is the agreed value between two parties for the sale of the property that is identifiable in the deed of sale.

Example. An agricultural land with house located in Batangas was sold for 4,000,000.00. Upon inspection of the deed of sale, it is indeed 4,000,000.00 pesos. Therefore, the selling price is 4,000,000.00.

Taxable price

The taxable price is established by identifying first the three bases of value for the property - zonal value, market value from tax declaration, and selling price.

The image above describes the Section 29 and 30 of BIR Form 1706 - Capital Gains Tax. It is important to note that 29A, 29B, 29C, and 29D must be established. Zonal value of the land refers to 29C. Zonal value of the improvement (e.g. condominium) is 29D. Market value from tax declaration for the land is 29A. And lastly, 29B refers to the market value from tax declaration for the building/improvement.

Example: A house and lot was sold in Cainta, Rizal by paying cash and the following values were established:

- Selling price is 2,300,000.00

- 29A is 100,000.00

- 29B is 600,000.00

- 29C is 1,500,000.00

- 29D is 0.00 - no zonal value for building/improvement for house; 29C is enough

Determination of the taxable base is where we arrive the taxable price or taxable base. For common property sale, either 30A, 30B, and 30C is enough. 30E is for those availing capital gains exemption, which is not discussed in this article. 30D and 30F will require assistance of a competent BIR examiner.

30A - Gross selling price of the property is 2,300,000.00. 30C is crucial as we need to determine the highest value possible and compare it to 30A. 30C iterates that:

30C - Sum of 29A & 29B / 29C & 29D / 29A & 29D / 29B & 29C, whichever is higher

We need to make a table and establish the sums:

- Sum of 29A & 29B - 100,000.00 and 600,000.00 is 700,000.00

- Sum of 29C & 29D - 1,500,000.00

- Sum of 29A & 29D - 100,000.00

- Sum of 29B & 29C - 2,100,000.00

30C is equal to 2,100,000.00. 30A is 2,300,000.00. The higher amount determines the taxable base. Therefore, the taxable base is 2,300,000.00.

How to compute for the taxable price of property donated?

Coming from BIR website, the taxable price of property donated is established as follows:

If the gift is made in property, the fair market value (FMV) thereof at the time of the donation shall be considered the amount of the gift. In case of real property, the zonal value as determined by the Commissioner or the FMV as shown in the schedule of values fixed by the Provincial/City Assessors, whichever is higher, shall be considered the amount of the gift.

The donor's tax is available here.

By interpretation, this also follows the establishment of taxable price in 30C of BIR Form 1706 - Capital Gains Tax Return, discarding the selling price since the property was donated.

Hope you would like this lengthy explanation of establishing taxable price for real properties that are either donated or sold.

Please support the continuation of this blog by making deals with the author. He has listings for sale and for rent and preselling.

Thank you very much!

This comment has been removed by a blog administrator.

ReplyDeleteThank you for this insight at Camella Manors

ReplyDelete